When You Can’t Buy What’s Not For Sale: Bring On 2024!!!

2023 was a record-breaker in Real Estate – but that’s not all good: Sure, SoCal prices remained robust, boosting Homeowners’ equity, but the spike in mortgage interest rates and a shortage of properties for sale sent the number of sales tumbling to a 28-year low!

Well, buckle up! Expect sales to climb steeply in 2024 – by some estimates the volume of sales could see the biggest annual gain in more than four decades!

“Why would that be?” you might ask – Luckily you have me here to tell you J

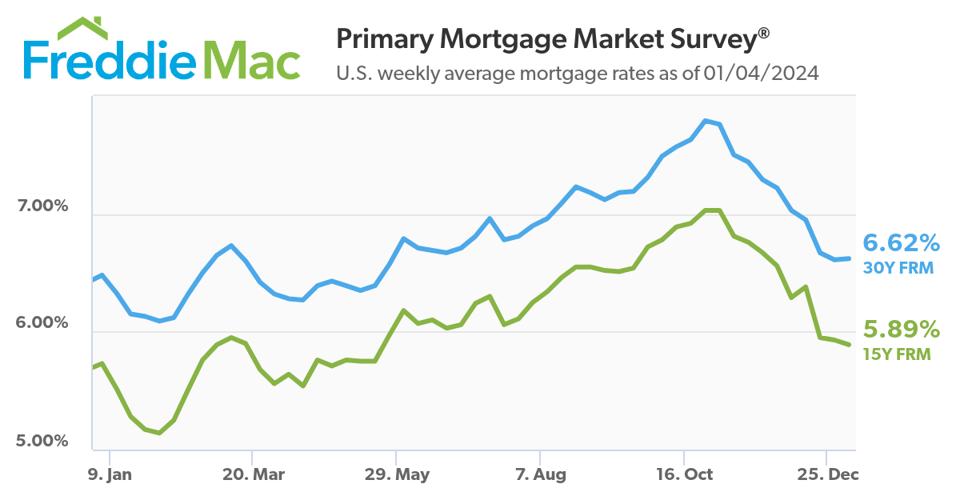

Lower Mortgage Interest Rates in 2024 — The Mortgage Bankers Association is forecasting rates somewhere around 6% by the end of 2024, down from a peak of 8.45% in October 2023 — some Economists predict perhaps as low as 5.5%. There is pent-up demand among Sellers itching to pull the trigger as rates move lower: To be blunt, all the families with new-born babies, or job changes, or newlyweds, or newly-divorced, or retirees – or any number of life changes – have been waiting for rates to come down to move to something that suits them better. 6% will entice more Homeowners to give up the super-low rates they got during the Pandemic and put their homes on the market – Inventory of properties for sale could climb as much as 30% from 2023’s all-time low!

While those 6%-ish rates are a far cry from the historic lows of 2020 and 2021, when people were able to buy homes or refinance mortgages with rates in the 3s and even into the 2s, the sharp run-up into the high 7s and beyond as the Federal Reserve battled inflation has made rates in the 6s more acceptable.

Falling Mortgage Rates combined with rising incomes (have you been following all the strike settlements and employment stats?) will increase demand for housing even further, bringing even more Buyers to the party. The result? Expect Home prices to continue to climb in 2024! We’re talking new all-time highs!

Consumer Confidence surveys show that Homebuyers are becoming more acclimated to higher mortgage rates – our “new normal” – with significant numbers ready to come off the sidelines.

Even though New Building Permits issued in Dec 2023 outstripped expectations and grew 2% (a step in the right direction to improve supply!), California’s persistent housing shortage is another factor expected to help push SoCal median home prices to continue their rise steadily across 2024.

First-time Buyers who were squeezed out by the highly competitive market in the last couple of years will regroup to attain their American Dream. Repeat Buyers – Homeowners who sell and go on to buy replacement homes immediately – will overcome the “lock-in effect” in significant numbers and return to the market as mortgage rates continue to trend down.

The housing market has been on quite the roller coaster ride since the beginning of the Pandemic – frustrating both Buyers and Sellers while underlying property values remained strong. The onset of the Pandemic and the changes it triggered redefined the role of a Home. As work-from-home became the standard, a house was no longer just a dwelling or a vehicle for wealth creation, but also an office, a classroom, a daycare and even a gym. The broadening role of the home in American life, in conjunction with record-low mortgage rates, powered the housing market to multiple records during this unprecedented time — the fastest annual house price appreciation, the lowest days on market, and a near-record pace of sales.

2024 looks to bring some relief to both sides and promises some steps towards a more balanced situation. That’s something to celebrate!

Where do you fit into this? “Call Paul!” 310.218.9256! Together we’ll explore your particular circumstances. A conversation costs you nothing, but the results can be life-changing!

Cheers & Be Well – Let’s talk soon!

Join The Discussion